According to Winston Churchill, “We make a living by what we get, but we make a life by what we give.” Generosity is at the core of who we are, whether we realize it or not, whether that be our time, our resources, or our love to others. If only all three of these were tax deductible. When looking at different tax strategies, ones centered around charitable giving do not get as much press as others, but for the right person they can be beneficial.

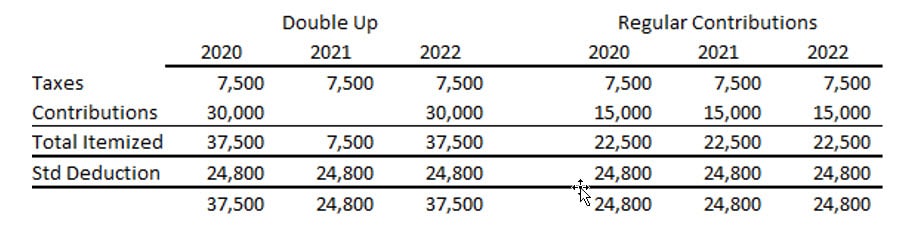

One such strategy is known as the “Double-Up” strategy. The premise for this approach is to give double your charitable contributions in one year, and none the next year. For this to work you would need to be able to itemize your return rather than taking the standard deduction on the years you give double. Please see the table below for an example.

This instance reflects the standard deduction levels at what they will be in 2020, for the years 2021 and 2022. Giving at this level each year may be a stretch for some, however, there are some options for how to give these amounts on a consistent basis.

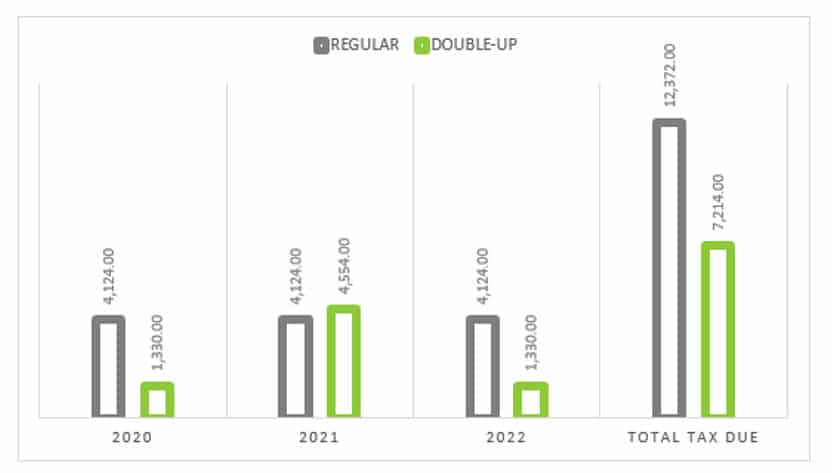

The first and simplest way many people give is through cash. However, many people may not have the cash flow to achieve giving double their normal rate every other year. Another option year would be to set up a Donor Advised Fund. This fund allows you to contribute stocks or cash in 2020 and distribute those funds whenever you want, while still picking up the deduction for the year in which the contributions were made. For example, if I contribute to a Donor Advised Fund in 2020, I will take the deduction in 2020, and I can distribute the funds in 2020 or in future years to the charity of my choice. As well as using a Donor Advised Fund, another option for increasing charitable contributions is through Qualified Charitable Distributions (QCD’s). For a QCD to be beneficial, a taxpayer would need to be currently taking RMD’s. QCD’s are distributions from IRA’s in place of RMD’s and can also help lower the taxable portion of RMD distributions from an IRA. For example, a taxpayer usually takes around $20,000 a year in distributions from their IRA, all of which is taxable, less any withholding. If $15,000 of that $20,000 was taken as a QCD, it increases the amount of contributions while also decreasing the taxable portion of the IRA distribution from $20,000 to $5,000. However, in using a QCD to fulfill your giving, the portion given to charity does not count towards your charitable contributions on Schedule A, and must go straight to the charity upon withdrawal. All three of these strategies are viable options for people wanting to give to their charity of choice. Below is a summary graph of how the table above, might affect the taxes due.

If you have questions about this strategy of any other questions regarding your taxes, please reach out and let us help you navigate the complex world of taxes.

Site Design: © Copyright Forge Media ™