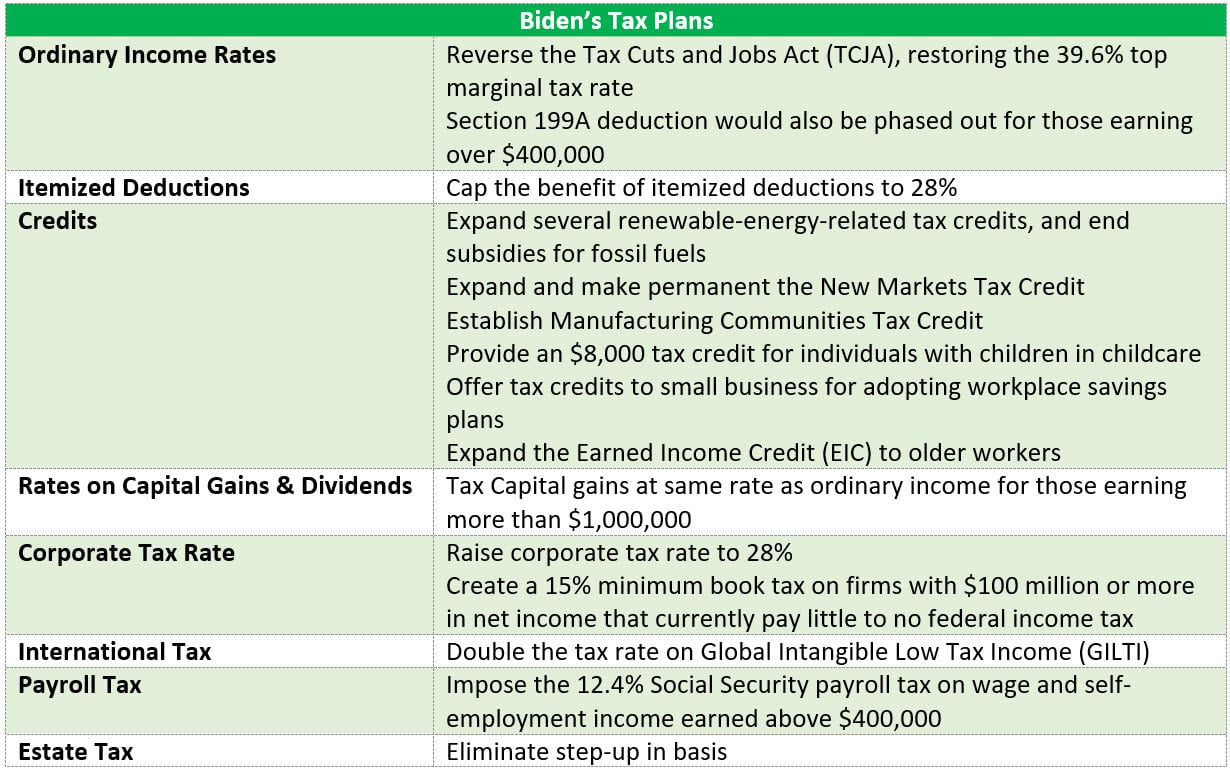

As the 2020 presidential election quickly approaches, the possibility of governmental changes are par for the course. With Vice President Biden officially accepting the nomination as the Democratic presidential candidate, questions arise pertaining to his tax proposals and when they will be implemented. If Vice President Biden is elected there will likely to be an overhaul to a variety of the Trump administration’s initiatives. Below are some of the key tax initiatives that Vice President Biden has proposed during his campaign.

It has been rumored that if Biden is elected and the economy is still showing signs of volatility due to the current coronavirus pandemic, he may be open to slowly implementing some of the tax proposals above until the economy improves. According to the Tax Foundation:

“While Biden’s tax plan would make the tax code more progressive, it would reduce after-tax incomes for filers across the income spectrum by reducing the incentive to work and invest in the United States. On average, taxpayers would see a 1.7 percent reduction in after-tax income on a conventional basis by 2030, ranging from 0.7 percent decline for those in the bottom quintile of the income distribution to a 7.8 percent decline for the earners in the top 1 percent.”

In summary, Biden’s tax proposal has two main points:

As the election approaches, these tax policies need to be kept in mind when planning for your 2021 financial transactions. We will be distributing more information and taking a deeper look into how these policies might affect small business and individual taxes in the months to come. If you have any questions or would like for us to run a tax projection for 2020, please let us know.

Site Design: © Copyright Forge Media ™